COP-26 witnessed a historic moment when India committed to achieving Net Zero by 2070, and the Ministry of Road Transport and Highways announced a target of EV30@2030—30% of newly registered private cars, 40% of buses, 70% of commercial cars, and 80% of 2-wheelers and 3-wheelers will be electric by 2030. The states have a critical role in accelerating the transition to electric vehicles, and it was with this goal that the Government of Tamil Nadu launched its first Electric Vehicle Policy in 2019.

The policy envisioned attracting INR 500 billion in investments with an opportunity to create 150,000 new jobs and outlined several measures to support them. However, even after three years of policy adoption, the uptake for electric mobility is fairly low. Data from the Vahan Portal shows that in 2022 only about 3.9% of vehicles registered in the state were EVs, and this number was just 2% in 2021. One key reason was the policy’s focus on non-fiscal demand-side incentives, such as tax exemption and registration fees, whereas it lacked upfront capital subsidies for vehicle purchases.

Taking proactive steps to improve the low electrification rate, the state government started the process of revising the policy in 2021, to plug the gaps in the 2019 policy and address EV adoption with a more comprehensive approach. The state launched the revised EV policy in February 2023. We take a look at why the revised policy is important, how it compares with other states, and the way forward for the effective implementation of the policy.

Why is the 2023 EV Policy important?

The Industries Department, which anchored the creation of the 2019 EV Policy, took up its subsequent revision through a consultative process with various stakeholders—including original equipment manufacturers (OEM), charging point operators (CPO), private bus operators, and financial institutions. As part of the consultations, ITDP India also provided recommendations to the Industries Department on various aspects of the policy, including fiscal incentives for all buses, EV charging tariffs and demand-based energy pricing, and incentives for public charging infrastructure to cover commercial vehicles, including buses.

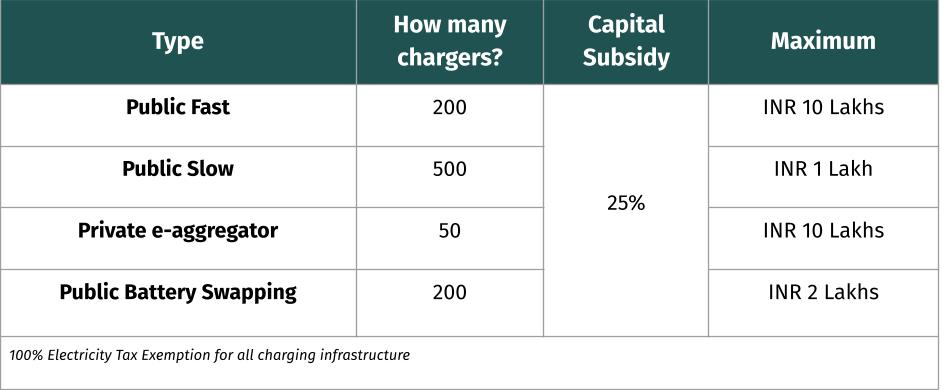

The revised policy gives the state an edge over others by attracting investments in manufacturing, revolutionising it as an EV hub for the nation and, at the same time, encouraging the shift of commercial fleets to EVs by giving upfront capital subsidies. For consumers to shift to EVs, the availability of charging infrastructure is critical. The aspect of public charging infrastructure was not addressed in the previous policy, but the current policy incentivises investment and the setting up of public charging and swapping stations.

In addition to the provisions of the 2019 Policy, the revised policy looks at the following aspects:

- Supply-side incentives – the policy aims to bring in investment in the state and offers more subsidies and incentives than the previous policy (such as Turnover-based Subsidy, Green Industry Incentive, Quality Certification Incentive etc.).

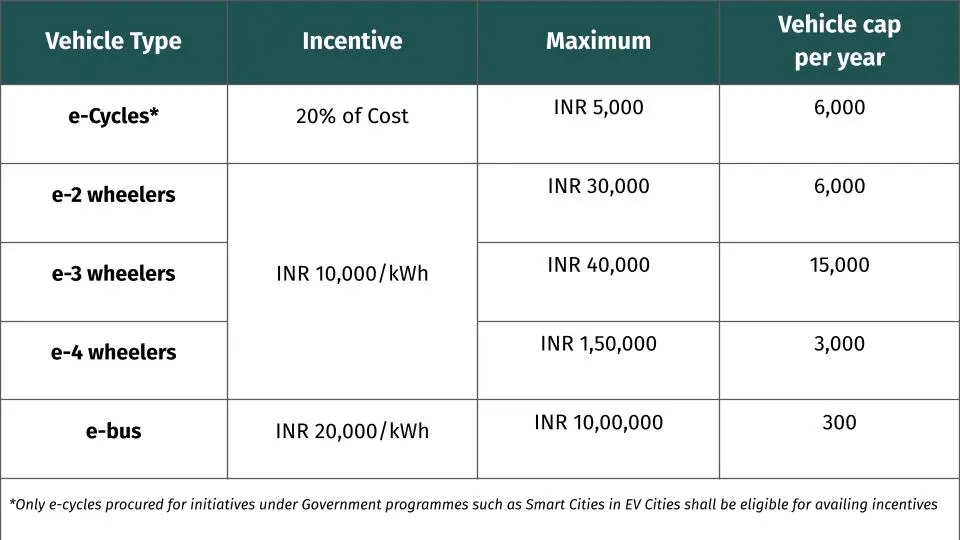

- Special demand-side incentives – To focus on the electrification of public transport and shared mobility, the policy seeks to incentivise only commercial vehicles.

Written by Sanjay Krishna and Faraz Ahmad Edited by Keshav Suryanarayanan

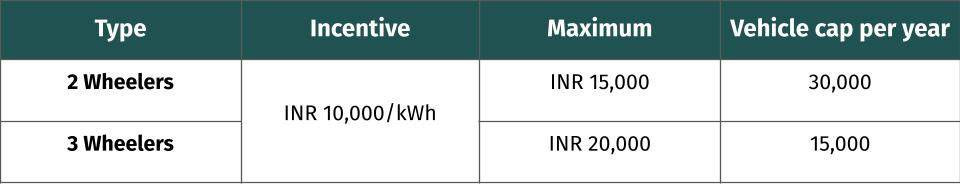

- Retrofitting incentives – The policy facilitates the shift of existing internal combustion engine (ICE) commercial 2- and 3-wheelers to electric by offering retrofitting incentives. This incentive is one of a kind, and 3-wheeler fleets would especially benefit from this. Currently, the cost of retrofitting 2-wheelers is INR 25,000-65,000 and for 3-wheelers, it is INR 50,000-125,000. The incentives will reduce the retrofitting cost by 20-25%.

- Tariff revision to support EV charging stations – To foster the growth of public charging, the policy mandates the revision of energy tariffs by reducing existing charges by 75% for the first two years and by 50% for the subsequent two years. The energy tariff for public chargers falls under LT Tariff VII, and the energy charges vary from INR 8-12/kWh, bringing the reduced rates to INR 2-3/kWh. This will bring down the cost of operating EVs and, in turn, accelerate adoption.

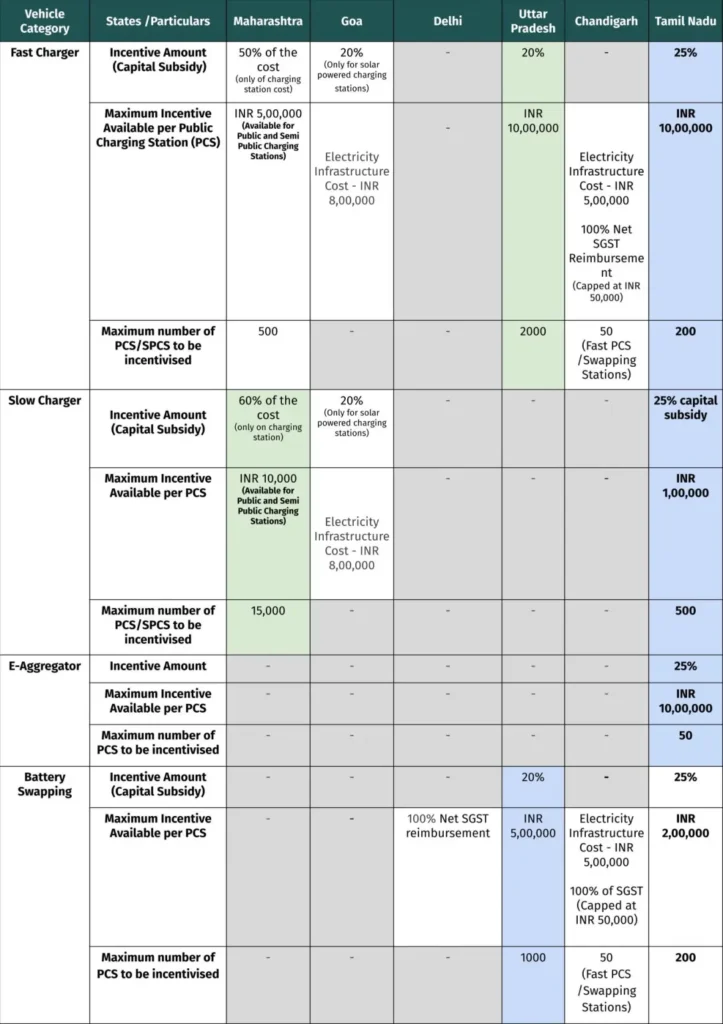

- Incentives for charging infrastructure – One of the most critical drivers for electrification is the availability of charging infrastructure. While the previous policy lacked incentives to facilitate initial momentum, the revised policy addresses this gap and provides a mix of support measures and incentives. With these incentives, the initial cost of setting up a charging station can be reduced by 20-25%. The EV Policy is also supporting private e-aggregators providing e-mobility solutions by providing incentives for setting up fast chargers for the first 50 applicants.

How does the 2023 EV Policy compare with the policies of other states leading electrification in India?

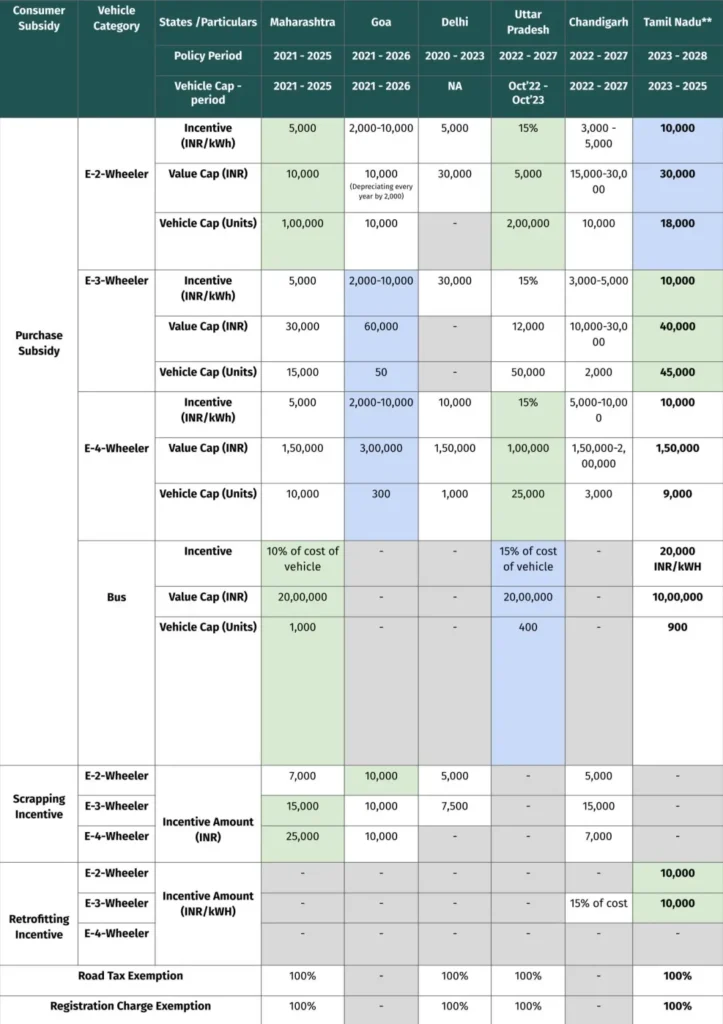

The above comparison shows:

- Tamil Nadu is amongst the states offering the highest incentives in terms of kWh of battery capacity. However, the number of vehicles incentivised is lower than in other states. These fiscal incentives would provide initial impetus for electrification, but the low vehicle cap could reduce momentum.

- While most states focus on scrapping incentives, Tamil Nadu has taken the lead in offering retrofitting incentives for 2-wheelers and 3-wheelers. This will not only support the conversion of ICE vehicles to EVs but also foster startups working on retrofitting in the state.

- All the demand incentives are tied only to commercial vehicles and not to private vehicles, thus strengthening the importance of electrifying public transport and shared mobility.

Table 4. Comparison of the EV Policy 2023 with other states selected on the basis of the number of EVs sold, with subsidies competing or at par with Tamil Nadu

**Incentives only available for commercial vehicles

The above comparison shows that Tamil Nadu provides the highest incentives to charging point operators, but the number of beneficiaries is restricted. This low number could reduce the momentum.

How does the policy address implementation?

- EV Cell to be set up at GUIDANCE GUIDANCE is a nodal agency under the aegis of the Department of Industries and Commerce, Tamil Nadu, for investment promotion and single window facilitation. The EV Cell will be instrumental in implementing the policy and monitoring the state’s progress. Delhi’s experience shows that a dedicated Cell can play a critical role in catalysing electrification. The EV Cell in Tamil Nadu can put policy implementation on the fast track by facilitating investments, ensuring effective communication and outreach to build awareness, facilitating interdepartmental coordination, deploying public charging infrastructure on a public-private model, and guiding cities to create implementation plans.

- 6 EV cities designated: Chennai, Coimbatore, Tiruchirappalli, Madurai, Salem, and Tirunelveli are designated as EV cities of Tamil Nadu wherein the Smart City Corporation/Municipal Corporation will act as the nodal agency to steer the electrification drive. These cities will work with the state EV cell to implement the policy, implement charging infrastructure, and develop roadmaps to meet the target of 100% electrification of three-wheelers.

Way forward

The Government of Tamil Nadu should capitalise on the momentum of the 2023 EV Policy.

- The policy has mandated the creation of an EV Steering Committee and an EV Cell. The policy mentions that the Steering Committee would include representatives from various state departments, city agencies in the EV cities, academic institutions, and technical experts. Additionally, it is crucial for the EV Cell to also include these representatives from various stakeholders to ensure faster coordination, conflict resolution, and implementation.

- The EV Cell would develop a state-level roadmap for scaling up charging infrastructure and electrification of 3-wheelers and public/private buses. This document should address the various aspects of policy implementation in an integrated manner, to become the guiding document for all the cities in the state.

- Based on the state-level roadmap, each city should create city-level implementation plans with inputs from local stakeholders and the public. This plan should include required infrastructure development, such as public charging and battery swapping stations, along with effective communications and outreach to support fleet electrification.

The EV Policy 2023 is a great next step by the Government of Tamil Nadu towards accelerating transitioning to electric mobility across the state. We look forward to supporting the state and the EV Cell on the implementation of the policy.

Recent Blogs

E-mobility: a game-changer for Informal Public Transport in India